What Kind of Travel Insurance Best Matches Your Travelling Profile?

Singaporeans took almost 10 million trips in 2017. With an increase in travel insurance awareness due to clever marketing campaigns and an increase in information surrounding its importance, it is reasurring to know that almost 97% of Singaporeans were aware of travel insurance when booking their travel packages. However, just because you know about it doesn't mean you will purchase the best policy for your needs. Here, we'll discuss the most common types of travellers and what kind of travel insurance they'll benefit the most from.

Frequently Travelling Businessmen/women

If you travel frequently for work (4-8 or more trips per year) and your company doesn't supply travel insurance, you may benefit the most from getting a annual travel insurance policy. Not only will this save you money over the course of the year, it will also save you the headache of having to search for a policy every time you go on your trip. For instance, those go who on at least one 3-day business trip per month will save around 20% buying an annual policy as opposed to buying a single-trip every time.

If you are a manager and you take your team on business trips frequently, you can also opt for corporate travel insurance where you will have additional benefits like personal travel deviation, bail bond (for car accidents) and employee replacement coverage. For managers, travel insurance can be highly beneficial because the increase in business travel demand has been leading to higher air and hotel prices. In other words, travel insurance with a strong focus on trip inconvenience coverage can help protect you from higher losses from delayed or cancelled flights and their consequences.

Elderly Couples Going on Occasional Trips

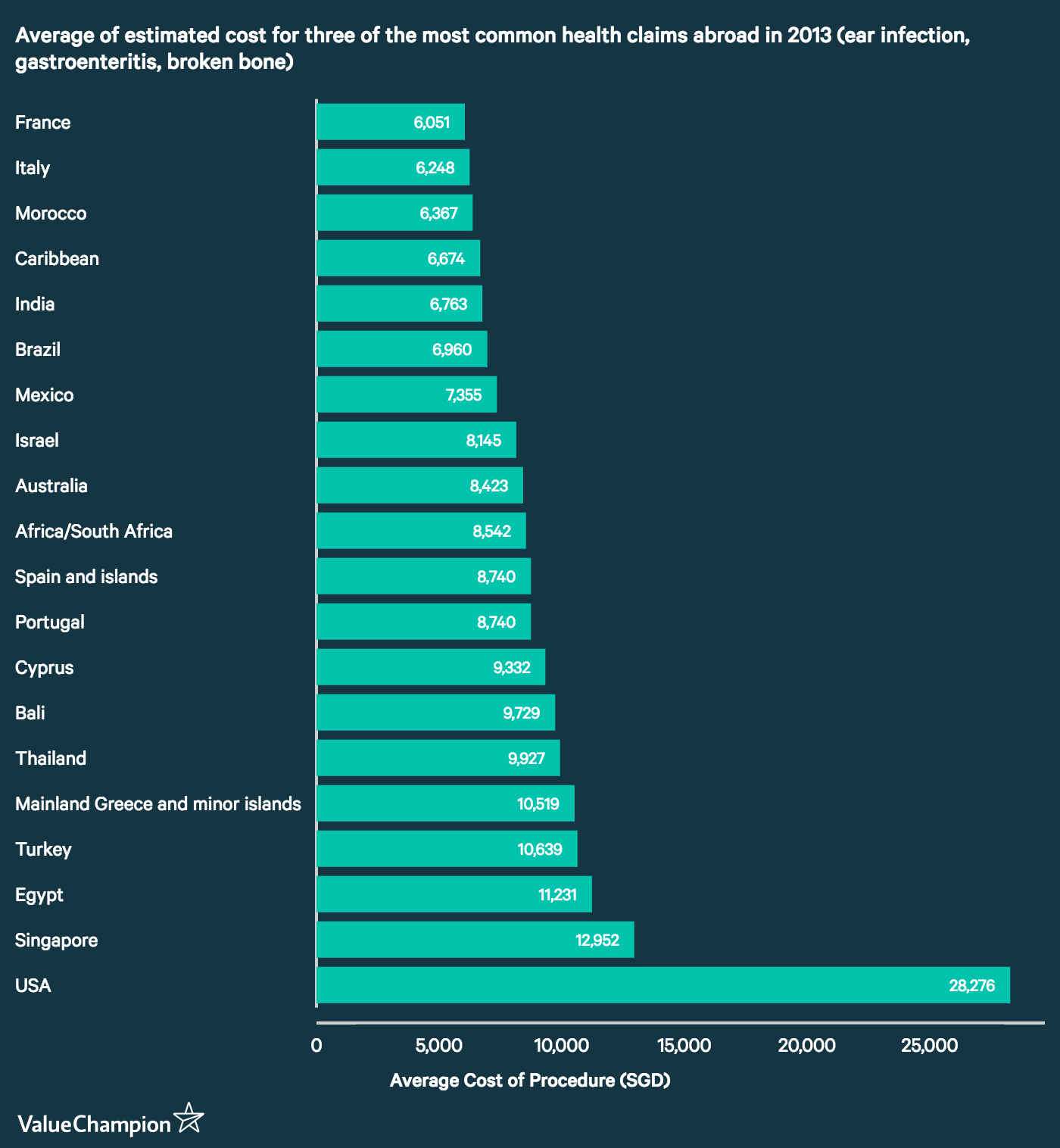

If you are elderly and only travel 1-2 times a year, a medically focused single-trip plan will fit you the best. Since you do not travel often, you may not benefit from an annual plan. Additionally, during this part of your life, medical issues like pre-existing conditions and injuries tend to be more a serious issue. Not only that, you may have to pay more overseas to receive the same benefits and comforts as you do in a doctor's office back in Singapore. Because of these reasons, your best travel insurance policy will be one offers maximum levels of hospitalisation, repatriation, pre-existing conditions and personal accident coverage. You may have to pay a bit more on your premium but considering that some countries charge tens of thousands of dollars for healthcare services, this slight increase in cost can save you thousands in the event of an emergency.

There are a few caveats that you have to watch out for regarding the medical coverage offered by travel insurance. You should double check before you purchase your policy, whether the insurer will only cover medical services from a predetermined set of service providers. Although this generally means you will get better service compared to those offered by other local hospitals, it also means means that you may have to wait a long time before getting treated, depending on where your medical complication occurs. Additionally, it may be difficult to find a policy that covers pre-existing conditions. They do exist but they are costly and have high deductibles.

Family Trip Planners

Families in Singapore are more likely to travel with their families than the rest of the world, with 57% of Singaporeans citing that family bonding is one of the main reasons for taking a holiday. For travellers in this category, your travel insurance should provide ample inconvenience and medical coverage for your children and elderly parents but also be affordable. Since family vacations cost a lot more than travelling solo, it may feel tempting to find the cheapest plan. However, elderly parents and young children will require extra protection that may not be offered by very basic plans. If you are travelling with elderly relatives, you would want to avoid plans that don't offer certain medical assistance (like pre-existing medical conditions or emergency repatriation) to travellers over a certain age threshold. Young children may benefit from coverage that includes coverage for wholesome outdoors activities like hiking or skiing.

First-Time & Solo Travellers

If you're a first-time traveller, you may have a mixed bag of emotions as you finish booking your first trip. According to the 2015 Visa Global Travel Intentions study, around 40% of first time and solo travellers cited Malaysia as their destination of choice, with Hong Kong and Australia rounding out the top 3. The travel insurance that will best fit your profile will be a single trip policy either to the ASEAN or Asia region. While you may want to settle on the cheapest policy, it may give you better peace of mind to opt for comprehensiveness over affordability and get a policy that has a wide breadth of coverage.

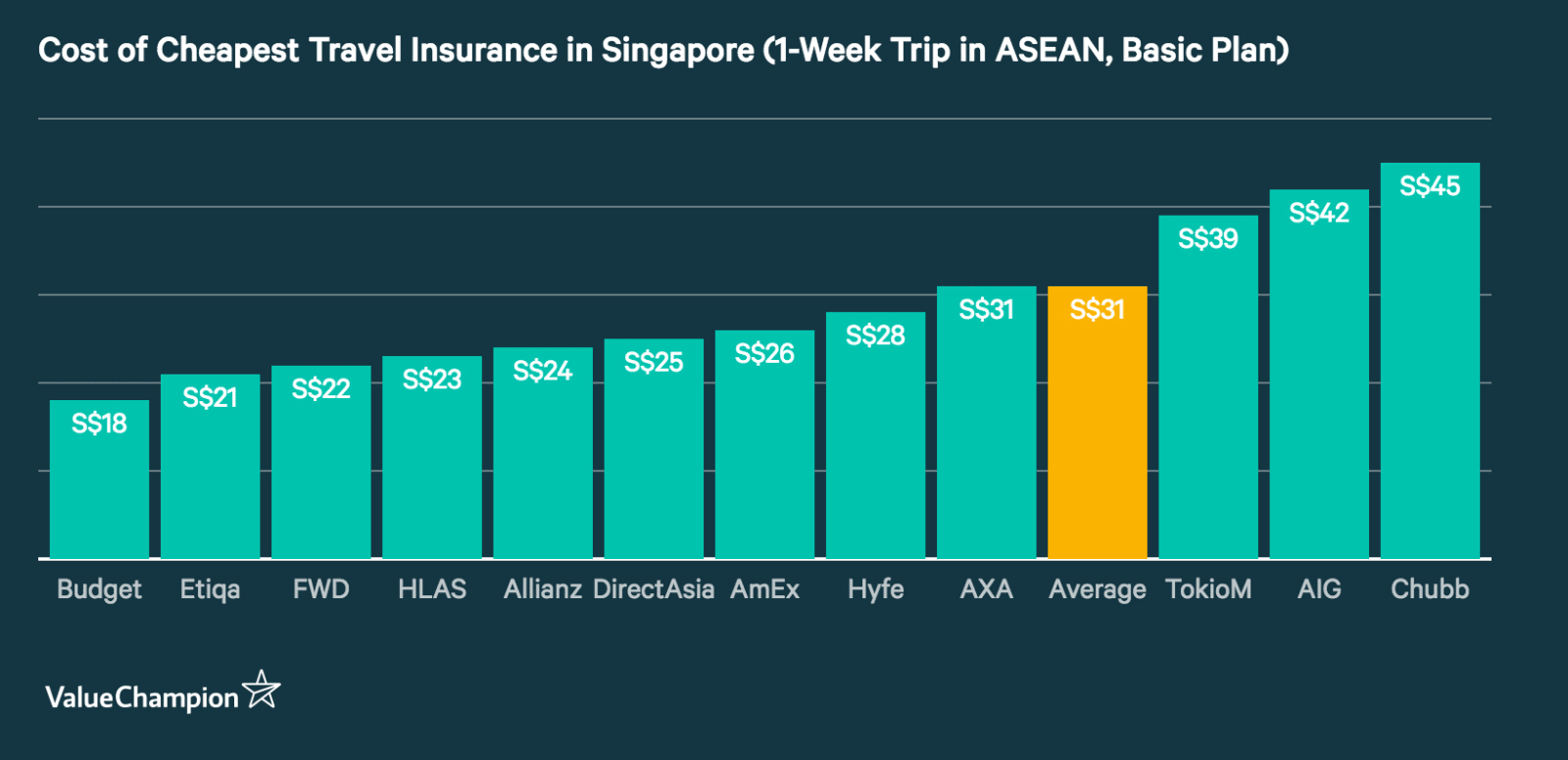

There are plenty of cheap policies that offer great coverage for lost baggage and trip delays, with several costing below S$30 for a one week ASEAN trip. However, you should be wary about policies that promise too many benefits that you don't need. For instance, if you are travelling alone to Hong Kong, it is doubtful you'll need family or kidnapping coverage—but you may need to get a policy that covers travel agency insolvency in case the travel agent you booked your entire trip with suddenly closes down.

Wealthy Travellers Taking Luxury Vacations

If you frequent exotic locations, stay at luxury hotels and can afford to do so multiple times a year, your best travel insurance fit will be a top-tier policy with high levels of personal effects and delay coverage. Since the average six-figure making Singaporean plans on travelling at least 5 times a year, you are free to choose whether you want to buy a single or annual policy. If you expect to travel more often, you can get your yearly insurance purchases out of the way and just get annual travel insurance. If you tend to take longer but fewer trips, single-plan policies will be your best bet or your high end credit card may already provide a comprehensive enough policy that lets you skip third party insurance plans altogether.

With the trend of culturally enriching bespoke trips becoming popular, your ideal type of travel insurance will also cover hiking, trekking and other adventurous activity. Since these trips usually take place in destinations that are off the beaten path and require layovers or connections, you will benefit from a policy that has flexible and generous trip inconvenience coverage. This is because even though baggage has been declining in the past 10 years a 12.5% drop in the past year alone, baggage loss tends to happen most during connecting flights. Additionally, you'll want a policy that protects your expensive belongings from theft and baggage loss/damage and throw in perks like loss of frequent flyer points, motorcycling and domestic pet care (to keep your pedigree pet well protected).

Singaporeans With Family in the ASEAN Region

If you are a Singaporean whose family is located in Asia (Malaysia, Thailand, China, India) and you visit them frequently, you should consider purchasing a very basic annual travel insurance plan. Even though you are going back to a familiar place and you may think you do not need it, travel insurance may end up being beneficial between the time you leave Singapore and get to your relative's house (think flight delays, trip cancellations, baggage loss). It's better to be safe than sorry and a cheap, basic policy will be sufficient enough to make sure that you arrive to your family in one piece.